Fast Company

Ý tưởng kinh doanh mới từ Fast Company

-

PwC limits its entry-level roles to just 13 locations

The biggest accounting firm in the U.S. just announced a major structural reset: PricewaterhouseCoopers (PwC) will now only hire new associates in its advisory division to work out of 13 offices, down from 72.

Yolanda Seals-Coffield, chief people and inclusion officer for PwC US, confirmed the decision to Business Insider, explaining that the move aims to foster a sense of community among workers. “The idea is that we want to bring people together in a connected way for those first couple of years,” Seals-Coffield said.

“You may start in Atlanta and then say, ‘Great, I’ve got my two years of experience. I want to go work in Alabama, which is where I’m from and where I really want to work,’” she said.

The slimmed-down choice of locations isn’t the only major change hitting the company. In recent years, PwC has delayed start dates for some entry-level consulting hires. And in 2025, it became clear that landing a job at the firm straight out of college would become more difficult; it announced it would recruit a third fewer new graduates by 2028.

The company has also been making major shifts toward upskilling its workforce in the era of artificial intelligence. On February 5, PwC announced the launch of its “Learning Collective,” a workplace training initiative that it describes as “an ecosystem for accelerated growth built for the possibilities of the AI age.”

“Learning can no longer wait for the right time, place, role, or ladder,” Seals-Coffield said in the announcement. “It needs to be a full-immersion experience that accelerates people and their organizations forward with speed.”

Despite the positive spin on the company’s clear gear shift, it’s hard to imagine that the recalibration doesn’t signal an age of growing uncertainty within the industry. Some experts say it’s a response to economic uncertainty, as well as an ever-changing world that’s grappling with how to best integrate employee capabilities with AI advances.

Deepali Vyas, global head of data and AI at global talent partner ZRG, tells Fast Company that in the AI age, “firms have to double down on what technology cannot easily replicate, including judgment, client presence, collaboration, and problem framing.” She adds that they must become “far more intentional about how they manufacture talent.”

Overall, that seems to mean entry-level roles are seriously shrinking as tasks typically done by first-year hires are increasingly being handed to AI. For Gen Zers who are hoping to get a foot in the door, the problem feels unavoidable, as some reports estimate that entry-level job postings are down by 35% since 2023.

PwC maintains that in a time when so many individuals work remotely for a good portion of the workweek, the move really is about employees getting back to learning from one another in a dynamic environment—which has become increasingly relevant during this post-COVID-19 era. Fast Companyspoke with a PwC representative who pushed back on the narrative that the shift signifies an industry slowdown and said that employees and the company alike can make big strides with a more collaborative approach.

Still, as searching for a job has become a truly anxiety-inducing part of life—even for the most competitive of college graduates—any amount of company downsizing is still going to read as a bad omen. When it comes to PwC, the major cut to office space is a highly visible one at that.

-

Bad Bunny streams jumped 175% in the U.S. after the Super Bowl

The legacy of Bad Bunny’s Super Bowl halftime show continues. Streams of his catalog jumped 175% in the U.S. on Monday, the day after the Super Bowl, when compared to the previous Monday, Feb. 2.

That’s according to Luminate, an industry data and analytics company that provides insight into changing behaviors across music listenership.

Bad Bunny received nearly 100 million streams on Monday in the U.S. — that’s 99.6 million in one day — compared to 36.2 million streams the previous Monday.

That’s noteworthy, too, because Monday, Feb. 2 was the day after the 2026 Grammys, when the artist born Benito Antonio Martínez Ocasio won album of the year. It marked the first time an all-Spanish language album took home the top prize. And as a result, he was already seeing a significant jump in streams: On Feb. 2, his on-demand U.S. streams spiked 117% from the previous Monday, Jan. 26.

And globally, Bad Bunny’s on-demand streams increased 132% on Monday, Feb. 9, compared to Feb. 2, a difference of 271 million to 117 million.

Bad Bunny’s most-streamed songs in the U.S. on Monday, Feb. 9

1. “DtMF” with 10.4 million

2. “Baile Inolvidable” with 6.7 million

3. “NuevaYol” with 6 million

4. “Tití Me Preguntó” with 5.4 million

5. “EoO” with 4.5 million

On Monday, Apple Music, a Super Bowl halftime show sponsor, found that Bad Bunny’s show playlist became the most-played set list on the music streaming platform shortly after the performance. The Puerto Rican superstar went on to dominate the Apple Music Daily Top 100 Global chart, landing 23 songs in the Top 100, including nine in the Top 25 and five in the Top 10. His track “DtMF” rose to No. 1. His album Debí Tirar Más Fotos appeared on album charts in 155 countries, reaching the Top 10 in 128 countries and hitting No. 1 in 46, including Mexico, Colombia, Chile, Brazil, Germany, France and Spain.

Spotify found that U.S. streams of Bad Bunny’s music jumped 470% on the platform. That’s when examining an hourly increase in U.S. streams between 9 p.m. and 3 a.m. ET on Sunday, Feb. 8, compared to the same time frame the week prior.

And Amazon Music reported that streams of Bad Bunny’s music in the U.S. jumped 480% following his performance.

Music discovery platform Shazam reflected a similar spike in engagement. Apple Music said Bad Bunny’s performance Sunday marked the biggest day ever on Shazam for any Latin or non-English-language artist. Across Bad Bunny’s catalog, Shazam recognitions increased by more than 400% during and immediately following the halftime show compared to the daily average.

—By Maria Sherman, AP music writer

Associated Press Entertainment Writer Jonathan Landrum Jr. contributed to this report.

-

What even is a ‘low-hire, low-fire’ environment?

2025 was defined by reports of a “low-hire, low-fire” environment: The unemployment rate remained fairly low, at just over 4% in December, yet headlines of constant layoffs seemed to dominate the news cycle, and those who are unemployed are taking longer to find work.

It’s all been very confusing. And the most recent U.S. jobs report, released today, presents more mixed signals.

This week’s report indicated that American employers added 130,000 jobs in January, and the Labor Department reported the unemployment rate fell to 4.3%. Everything in the report isn’t good—it also indicated just 181,000 jobs were created last year, which is the lowest number since 2020—but perhaps it’s not quite as bad as many predicted.

So will “low-hire, low-fire” still be the way we describe a new job market for a new year?

What is a “low-hire, low-fire” economy?

A “low-hire, low-fire” economy is defined by a low number of job hirings coupled with low job firings. Having slashed 108,435 jobs last month, employers aren’t making big moves now in either direction. This kind of economic dynamic results in a lower number of available jobs, which means that those 100,000 people who are out of work may struggle to find something sustainable. That, in turn, could mean that unemployment rates will rise in the coming months.

High-profile job cuts, such as news of hundreds of layoffs at The Washington Post last week, can also stoke fears of trends in the broader labor market, CNBC noted this week. Other companies that have announced layoffs include Amazon, UPS, and Dow.

UPS says it intends to cut 30,000 workers, and last month Amazon announced plans to lay off 16,000 people. The two companies account for nearly 40% of all of January’s layoff announcements.

“Generally, we see a high number of job cuts in the first quarter, but this is a high total for January,” Andy Challenger, chief revenue officer at global outplacement firm Challenger, Gray & Christmas, said in a statement. “It means most of these plans were set at the end of 2025, signaling employers are less than optimistic about the outlook for 2026.”

How we got here

American employers announced that more than 100,000 jobs were cut in January—a jump of 118% compared with the same month last year, and the highest for any January since 2009, according to a statement this month from Challenger, Gray & Christmas.

At the same time, employers announced plans to hire only 5,306 workers, the company reported on February 5, which is the lowest number for the month since it began tracking employment trends in 2009. That same day saw a jump in first-time unemployment claims: Per CNN, there were 231,000 initial jobless claims filed at the beginning of February, an increase of 22,000 claims from the week before.

The reasons given for the fresh 2026 job losses include contract loss, market and economic conditions, restructuring, and closures. Last year’s layoffs were attributed to much of the same, though a pivot to artificial intelligence often gets cited as well, regardless of how much of a factor the technology really is.

Data released by the Bureau of Labor Statistics also supports the idea that the job market may get a little tougher, sooner rather than later. Job openings dropped to 6.5 million at the end of December—the lowest since September 2020. Some of the causes for that drop are political, CNN also reported, and many employers are concerned about import and export tariffs issued by the Trump administration last year. Some companies are focusing their hiring efforts on the world of AI instead and, therefore, the so-called hiring recession may linger.

There is a (potential) bright side: Reports from Challenger compile layoff intentions—so actual job losses may not take place for weeks or even months, if they take place at all.

Inside the latest economic report

Although job growth can be described as sluggish at best, the American economy is still chugging along. This week’s job creation report far exceeded the 75,000 new jobs that many experts predicted, and average wages rose .04% from December 2025 to January 2026.

Some of the uncertainty surrounding job creation is due to the impact of high interest rates, a carryover of uncertainty that surrounds the Trump administration’s shifting trade policies. But per this week’s news, America’s output of goods and services logged its fastest pace in two years, at 4.4%, from July to September 2025, and consumers kept spending money. There’s also speculation from experts that job creation may catch up to economic growth, and the Trump administration’s tax cuts could result in increased consumer spending.

Perhaps the latest jobs news is an indication that the economy, much like other elements of American life, is in a state of flux that a little stability could resolve. “Low-hire, low-fire” may still be at play for a few more months . . . but the economy might just have time to catch up.

-

CBO predicts federal deficits and debt to worsen over next decade amid Trump’s policies

The nonpartisan Congressional Budget Office’s 10-year outlook projects worsening long-term federal deficits and rising debt, driven largely by increased spending, notably on Social Security, Medicare, and debt service payments.

Compared with the CBO’s analysis this time last year, the fiscal outlook has deteriorated modestly.

Major developments over the last year are factored into the latest report, released Wednesday, including Republicans’ tax and spending measure known as the “One Big Beautiful Bill Act,” higher tariffs, and the Trump administration’s crackdown on immigration, which includes deporting millions of immigrants from mainland U.S.

As a result of these changes, the projected 2026 deficit is about $100 billion higher, and total deficits from 2026 to 2035 are $1.4 trillion larger, while debt held by the public is projected to rise from 101% of GDP to 120% — exceeding historical highs.

Notably, the CBO says higher tariffs partially offset some of those increases by raising federal revenue by $3 trillion, but that also comes with higher inflation from 2026 to 2029.

Rising debt and debt service are important because repaying investors for borrowed money crowds out government spending on basic needs such as roads, infrastructure, and education, which enable investments in future economic growth.

Congressional Budget Office projections also indicate that inflation doesn’t hit the Federal Reserve’s 2% target rate until 2030.

Jonathan Burks, executive vice president of economic and health policy at the Bipartisan Policy Center said “large deficits are unprecedented for a growing, peacetime economy,” though “the good news is there is still time for policymakers to correct course.”

“We encourage lawmakers to work together to explore options for raising revenue, trimming spending, and slowing the growth of the major cost drivers,” Burks said. “Congress and the administration should seize the opportunity to act now before the available menu of choices becomes much more painful.”

Lawmakers have recently addressed rising federal debt and deficits primarily through targeted spending caps and debt limit suspensions, as well as deploying “extraordinary measures” when the U.S. is close to hitting its statutory spending limit, though these measures have often been accompanied by new, large-scale spending or tax policies that maintain high deficit levels.

And President Donald Trump at the start of his second term deployed a Department of Government Efficiency, which set a goal to balance the budget by cutting $2 trillion in waste, fraud, and abuse; however, budget analysts estimate that DOGE cut anywhere between $1.4 billion and $7 billion, largely through workforce firings.

Michael Peterson, CEO of the Peterson Foundation said the CBO’s latest budget projection “is an urgent warning to our leaders about America’s costly fiscal path.”

“This election year, voters understand the connection between rising debt and their personal economic condition. And the financial markets are watching. Stabilizing our debt is an essential part of improving affordability, and must be a core component of the 2026 campaign conversation.”

—By Fatima Hussein, Associated Press

-

Amazon Pharmacy’s latest move could change how you get prescriptions filled

Amazon is expanding its same-day delivery services for its Pharmacy. In an announcement Wednesday the company said plans to bring Amazon Pharmacy to nearly 4,500 locations around the country, which is an addition of around 2,000 cities and towns by the end of 2026.

Amazon Pharmacy was first launched in 2020 in 45 U.S. states. By 2023, it served some locations in all 50. But the service has been continuously expanding to cover a growing number of locations since its launch while offering same-day delivery in more cities. Per Amazon’s announcement, the most recent expansion will now offer same-day delivery to its newly served customers in Idaho and Massachusetts.

“Patients shouldn’t have to choose between speed, cost, and convenience when it comes to their medication, regardless of where they live,” John Love, vice president of Amazon Pharmacy, said in the announcement. “By combining our pharmacy expertise with our logistics network, we’re removing critical barriers and helping patients start treatment faster—setting a new standard for accessible, digital-forward pharmacy care.”

Amazon Pharmacy has served as a competitor to traditional pharmacies since its launch, offering home delivery on most name brand and generic prescription medications. In 2023, Amazon also launched RxPass, a monthly subscription that offers Prime members in the U.S. as many generic versions of medications as they need for a $5 monthly fee.

Additionally, in December, the delivery giant began testing in-office pharmaceutical kiosks filled with medicine at certain One Medical locations. The kiosks aimed to help combat pharmacy deserts, or areas in the U.S. where traditional pharmacies have become more and more scarce.

According to research published in JAMA Network in 2024, around 15.8 million people in the U.S. live in pharmacy deserts. Unsurprisingly, areas with decreasing access to pharmacies are disproportionately affecting more socially vulnerable individuals.

Amazon’s announcement addressed the issue of a growing number of unserved communities in the announcement, explaining, “In pharmacy deserts, Amazon Pharmacy helps fill critical gaps through 24/7 access to licensed pharmacists, automatic refills, and PillPack from Amazon Pharmacy.”It continued, “PillPack from Amazon Pharmacy organizes medications by dose and time into easy-to-open packets and delivers them monthly to help customers and caregivers manage multiple prescriptions more reliably. In 2025, Amazon Pharmacy also introduced a caregiver support feature to help families manage medications for loved ones.”

-

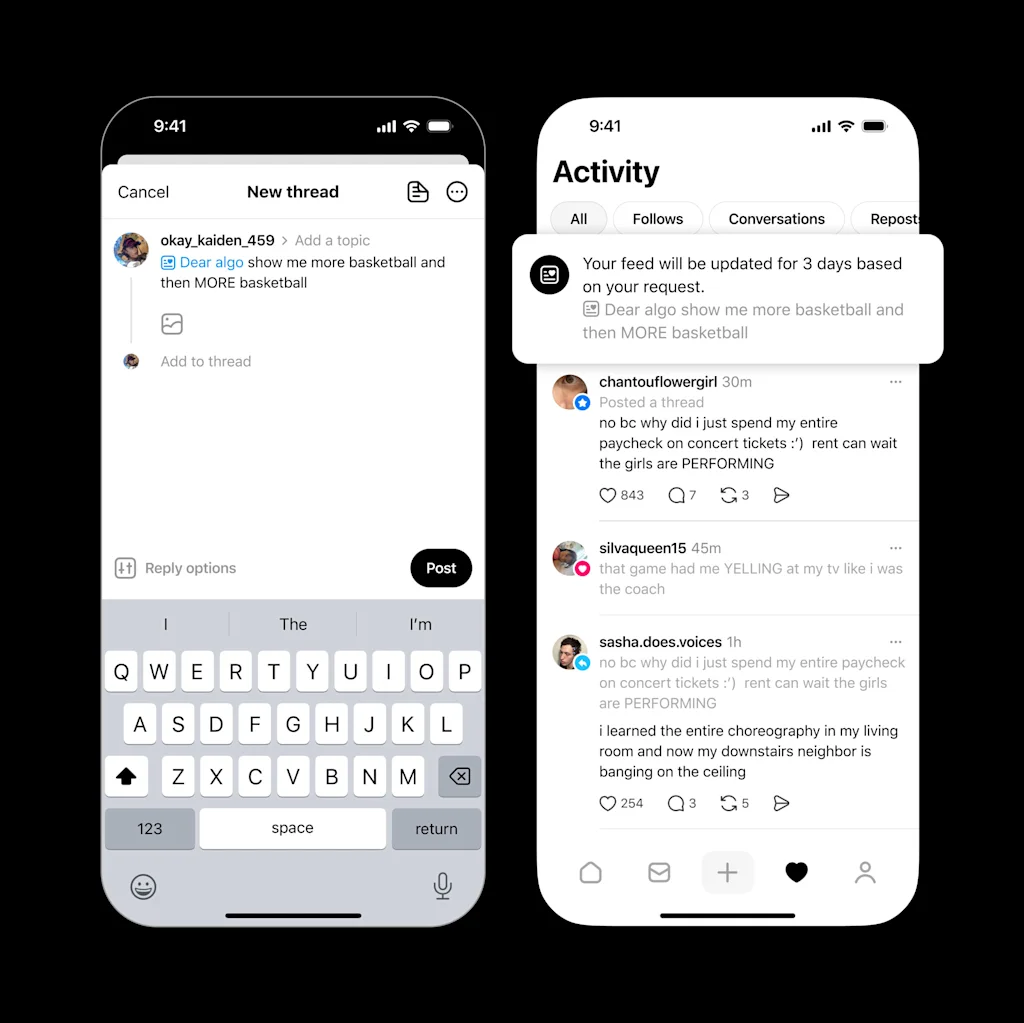

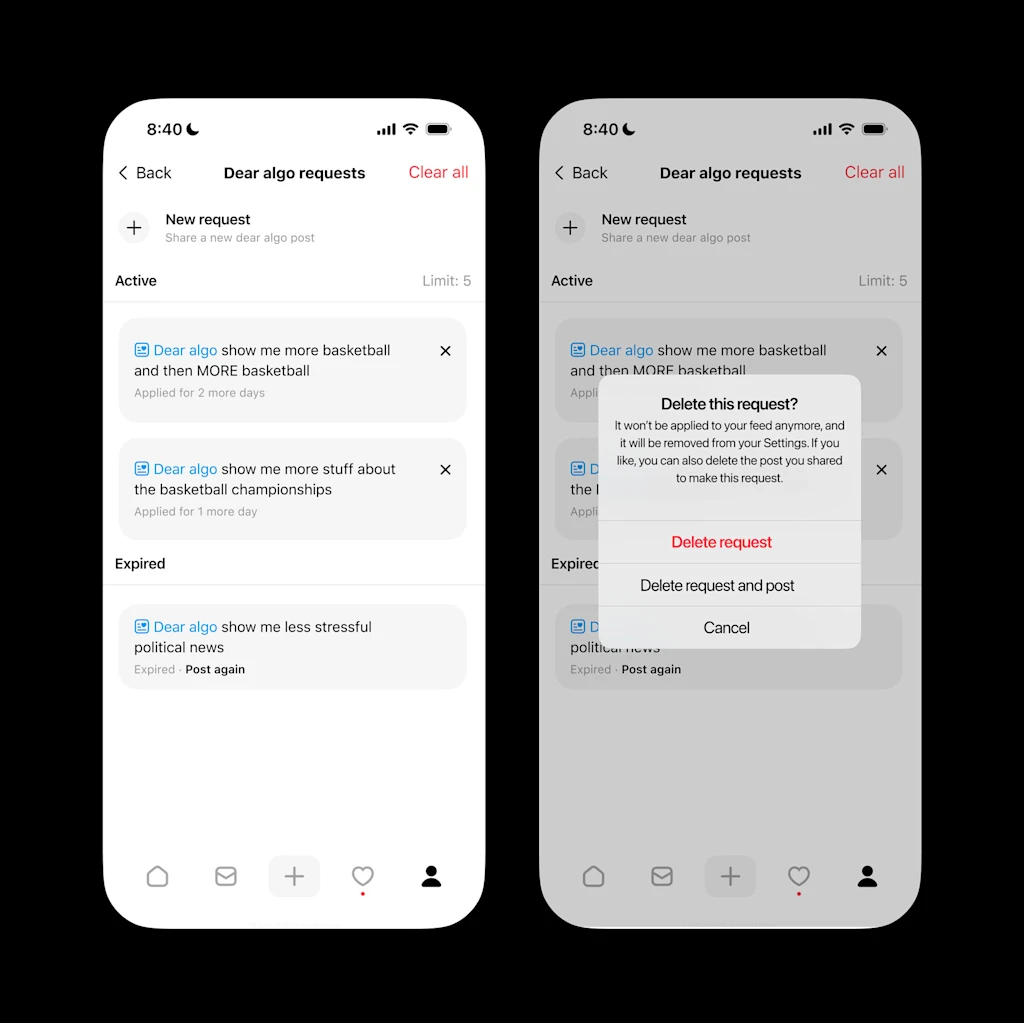

Threads now lets you rewrite your feed without ever opening a menu

Threads is testing a simpler way for people to nudge their feed in a specific direction without digging through settings or retraining the algorithm long term.

The new feature, called Dear Algo, lets users tell Threads what they want to see more or less of for a short period of time. Instead of relying only on likes, follows, and past behavior, you can now directly ask the app to adjust what shows up in your feed.

It works by writing a public post that starts with “Dear Algo,” followed by your request. For instance, “Dear Algo, show me more posts about podcasts,” or “Dear Algo, show me fewer posts about spoilers for Heated Rivalry.” After you post it, Threads adjusts your feed for the next three days based on what you asked for.

The change is temporary on purpose. During a live NBA game, you might want your feed filled with reactions and commentary. A day later, you might want to move on to something else.

Dear Algo lets you make those shifts without permanently changing how the algorithm understands you.

A public request others can use

[Image: Meta] These requests are regular posts, not private settings. Other users can see them, interact with them, and repost them.

If you repost someone else’s Dear Algo request, Threads applies those same preferences to your feed for three days. This turns feed preferences into a kind of discovery tool. If someone you follow is deep into a niche conversation you have not seen yet, you can try their version of the feed for a few days.

A more direct way to guide the feed

[Image: Meta] Most social platforms offer some form of feed control, but it’s usually tucked into menus or tied to long term settings.

“Controlling your algorithm shouldn’t be complicated. It should feel like a normal part of using the app,” Connor Hayes, head of Threads at parent company Meta Platforms, tells Fast Company. “We saw our community experimenting with ‘Dear Algo’ posts to shape their feed, which inspired us to turn that behavior into an official feature that feels unique to Threads.”

He added, “When what you care about shifts—whether it’s a big game tonight or a TV premiere next week—you should be able to tell your feed to shift with you. This is about making Threads the most timely and essential place for what’s happening right now.”

Where it is available

Dear Algo is rolling out now in the United States, New Zealand, Australia, and the United Kingdom, with plans to expand to more countries.

-

My job offered me a voluntary severance. Here’s what my decision taught me

If your employer offered you a lump sum to permanently ditch the job that stresses you out like no other, would you take the money and run—or worry about what it might cost you later? I never thought I’d actually encounter this career conundrum. Looking back, I’m surprised by the choice I made.

The all-company virtual meeting initially seemed like any of the weeklies that had preceded it. There was a weird icebreaker to get folks loose, various team updates, some HR housekeeping. Then the billionaire who signed all of our checks took the screen.

For months, senior leadership had been deprioritizing a project that I—and the vast majority of my colleagues—had been specifically recruited to the startup to produce. They called it a strategic realignment. Or something like that. Our CEO knew many of us weren’t exactly enthusiastic about the reroute. Achieving this newfound mission, he explained, would require the company to get lean. He wasn’t referring to Ozempic.

In retrospect, the writing was on the wall like Destiny’s Child’s second album. But those markings might as well have been hieroglyphics, because I sure as hell couldn’t decode them. I didn’t anticipate what came next.

Corporate folks call it a “voluntary separation package,” (VSP) but at the time, it seemed like both a trap door and an escape. It was a lot like the severance packages that most professionals are familiar with, but instead of outright cutting roles, the company presented every employee with a tantalizing offer: five months of gross salary and half a year of covered health insurance. All that was asked in return was that you leave the company. And don’t look back.

We had a week to decide. Workflows hit a halt. All outstanding deliverables entered a strange purgatory. For my coworkers, the VSP became the only topic of discussion, as whispers spread about who was clocking out for good, who would remain, and what would be left behind.

For some, the decision to secure the bag was a no-brainer. “You could have a dope summer,” said Gary, one of my Slack homies based in the DMV. He imagined months of passport stamps and midday mischief, and as he spoke, I could damn near feel the beach breeze sweeping across my brow.

Gary meant well, but I had to be real. These were the final days of quarantine. The pandemic had ravaged head counts at rival companies—and Black folks like me were often the first out of the door and seldom rehired. Those fortunate enough to be employed held onto their jobs tighter than Stevie Wonder and his locs. I wasn’t afraid of chucking the deuces. But I was afraid of starting over in a job market that had already shown me who it was willing to discard first. I didn’t have the luxury of pretending this decision was just about vibes.

That whole week, the second verse of Donell Jones’ “Where I Wanna Be” played on repeat in my head: “Do I leave? Do I stay? Do I go? Or think about my life and what matters to me the most?” Essentially, I was deciding between the risk of extended unemployment (albeit with a nice runway) or the uncertainty that awaited those who remained at the gig. Dominique Dawes had nothing on the mental gymnastics twirling in my brain.

The key to escaping decision paralysis was having conversations with the powers that be. Really, they were more like negotiations. What’s in it for me if I bypass five months of paid freedom and remain on the team? One of our directors hinted that the anticipated departures might open opportunities to ascend the org chart. She couldn’t straight up promise upward mobility, but I was very capable of reading between the lines.

For the first time since the offer was announced, the decision stopped feeling emotional and began to feel strategic. If I decided not to abandon ship, it wouldn’t be out of fear or blind loyalty. It would be because there was something tangible on the other side of “thanks, but no thanks.”

That week felt like a month, and it ended with an exodus. But I decided to stay put. And it worked out: I was elevated to senior management, and the work . . . well, let’s just say the pay bump motivated me to get on board with the new objectives. But sometimes I wonder how the opposite decision might’ve played out, considering the stream of job offers that came pouring in once word got out about the company shakeup. I’m not a math guy, but I’m smart enough to know two salaries beat one. (Gary would agree; he, like some of my other former colleagues, picked up a new gig within a few weeks.)

In the end, the voluntary severance was a lesson in recognizing my leverage. It forced me to ask what I wanted, what I was willing to risk, and what decision put me in the strongest position to win. For that one week, my value and my priorities were crystal clear.

-

These hidden devices on California roadways have privacy activists pushing Governor Newsom for their removal

More than two dozen privacy and advocacy organizations are calling on California Governor Gavin Newsom to remove a network of covert license plate readers deployed across Southern California that the groups believe feed data into a controversial U.S. Border Patrol predictive domestic intelligence program that scans the country’s roadways for suspicious travel patterns.

“We ask that your administration investigate and release the relevant permits, revoke them, and initiate the removal of these devices,” read the letter sent Tuesday by the Electronic Frontier Foundation, Imperial Valley Equity and Justice and other nonprofits.

An Associated Press (AP) investigation published in November revealed that the U.S. Border Patrol, an agency under U.S. Customs and Border Protection (CBP), had hidden license plate readers in ordinary traffic safety equipment. The data collected by the Border Patrol plate readers was then fed into a predictive intelligence program monitoring millions of American drivers nationwide to identify and detain people whose travel patterns it deems suspicious.

AP obtained land use permits from Arizona showing that the Border Patrol went to great lengths to conceal its surveillance equipment in that state, camouflaging it by placing it inside orange and yellow construction barrels dotting highways.

The letter said the groups’ researchers have identified a similar network of devices in California, finding about 40 license plate readers in San Diego and Imperial counties, both of which border Mexico. More than two dozen of the plate readers identified by the groups were hidden in construction barrels.

They could not determine of the ownership of every device, but the groups said in the letter that they obtained some permits from the California Department of Transportation, showing both the Border Patrol and Drug Enforcement Administration had applied for permission to place readers along state highways. DEA shares its license plate reader data with Border Patrol, documents show.

The letter cited the AP’s reporting, which found that Border Patrol uses a network of cameras to scan and record vehicle license plate information. An algorithm flags vehicles deemed suspicious based on where they came from, where they were going and which route they took. Agents appeared to be looking for vehicles making short trips to the border region, claiming that such travel is indicative of potential drug or human smuggling.

Federal agents in turn sometimes refer drivers they deem suspicious to local law enforcement who make a traffic stop citing a reason like speeding or lane change violations. Drivers often have no idea they have been caught up in a predictive intelligence program being run by a federal agency.

The AP identified at least two cases in which California residents appeared to have been caught up in the Border Patrol’s surveillance of domestic travel patterns. In one 2024 incident described in court documents, a Border Patrol agent pulled over the driver of a Nissan Altima based in part on vehicle travel data showing that it took the driver six hours to travel the approximately 50 miles between the U.S.-Mexican border and Oceanside, California, where the agent had been on patrol.

“This type of delay in travel after crossing the International Border from Mexico is a common tactic used by persons involved in illicit smuggling,” the agent wrote in a court document.

In another case, Border Patrol agents said in a court document in 2023 they detained a woman at an internal checkpoint because she had traveled a circuitous route between Los Angeles and Phoenix. In both cases, law enforcement accused the drivers of smuggling immigrants in the country unlawfully and were seeking to seize their property or charge them with a crime.

The intelligence program, which has existed under administrations of both parties, has drawn scrutiny from lawmakers since the AP revealed its existence last year.

A spokesperson for the California Department of Transportation said state law prioritizes public safety and privacy.

The office of Newsom, a Democrat, did not immediately respond to requests for comment.

Courts have generally upheld license plate reader collection on public roads but have curtailed warrantless government access to other kinds of persistent tracking data that might reveal sensitive details about people’s movements, such as GPS devices or cellphone location data. Some scholars and civil libertarians argues that large-scale collection systems like plate readers might be unconstitutional under the Fourth Amendment.

“Increasingly, courts have recognized that the use of surveillance technologies can violate the Fourth Amendment’s protections against unreasonable searches and seizures. Although this area of law is still developing, the use of LPRs and predictive algorithms to track and flag individuals’ movements represents the type of sweeping surveillance that should raise constitutional concerns,” the organizations wrote.

CBP did not immediately respond to a request for comment, but previously said the agency uses plate readers to help identify threats and disrupt criminal networks and their use of the technology is “governed by a stringent, multi-layered policy framework, as well as federal law and constitutional protections, to ensure the technology is applied responsibly and for clearly defined security purposes.”

The DEA said in a statement that the agency does not publicly discuss its investigative tools and techniques.

Burke reported from San Francisco. Tau reported from Washington.

Contact AP’s global investigative team at Investigative@ap.org or https://www.ap.org/tips/.

—Garance Burke and Byron Tau, Associated Press

-

Careers aren’t ladders, they’re quilts

At work, we still talk about careers like they’re ladders. As if success must be a straight line upward: more responsibility, bigger title, better office.

But that old image isn’t just outdated. It can be harmful. Ladders come with an unspoken message: If you’re not climbing, you must be falling. If you experience job loss, the ladder metaphor makes you feel like you slipped off and can’t recover. If you take a step sideways, it makes you look like you stalled and aren’t motivated. If you change careers completely, it can feel like you have to start from scratch.

Most people don’t need any more pressure or extra worry about what others think, when they’re already trying to make hard decisions about their work and their lives.

That’s why I think we need a better metaphor.

{"blockType":"mv-promo-block","data":{"imageDesktopUrl":"https:\/\/images.fastcompany.com\/image\/upload\/f_webp,q_auto,c_fit\/wp-cms-2\/2026\/01\/i-169-Ashley-Herd.jpg","imageMobileUrl":"https:\/\/images.fastcompany.com\/image\/upload\/f_webp,q_auto,c_fit\/wp-cms-2\/2026\/01\/i-11-Ashley-Herd.jpg","eyebrow":"","headline":"\u003Cem\u003EThe Manager Method\u003C\/em\u003E","dek":"Want practical leadership development training that actually sticks? Visit managermethod.com to learn more and order Ashley Herd’s book, \u003Cem\u003EThe Manager Method\u003C\/em\u003E.","subhed":"","description":"","ctaText":"Learn More","ctaUrl":"http:\/\/managermethod.com","theme":{"bg":"#2b2d30","text":"#ffffff","eyebrow":"#9aa2aa","subhed":"#ffffff","buttonBg":"#3b3f46","buttonHoverBg":"#3b3f46","buttonText":"#ffffff"},"imageDesktopId":91478992,"imageMobileId":91478994,"shareable":false,"slug":""}}Why a quilt is a better model than a ladder

Imagine a quilt. It’s not one long piece of cloth that stretches up into the sky. Instead, it’s many pieces, each with its own shape, material, color, and history, stitched together into something useful and uniquely meaningful.

That’s what modern careers look like:

- Pieces of skill you build over time

- Patterns of work that overlap and influence one another

- Mistakes, leaps, and detours that add texture

- Priorities and goals that can shift as life changes (sometimes by your own choice, and sometimes because a square ended before you expected)

A career quilt has direction, purpose, and depth. And unlike a ladder, it doesn’t require you to constantly compare your height to someone else’s.

How to think about your own career

If you’ve been picturing your career as a ladder, it’s easy to fall into critical self-talk about where you “should” be. You might feel behind or worry that a change means you’ve lost everything you’ve worked for. The ladder metaphor leaves very little room for life’s unexpected turns, or for choices that don’t look like a straight climb upward.

A quilt gives you a different way to look at your past, and your future. A job loss isn’t slipping off the ladder, it’s simply a square that ended before you expected. A pivot isn’t failure, it’s a new piece of fabric. A sideways move isn’t stalling, it’s part of your quilt that builds depth, resilience, and new skills.

So instead of asking, “What’s my next rung?” try asking, “What do I want my next square to be?” What skills do you want to strengthen? What kind of work feels most important to you right now? What chapter are you ready for, even if it doesn’t look like a promotion on paper?

Careers don’t have to be explained in a straight line to be valid. You’re allowed to choose your next piece intentionally, without worrying about how it looks from the outside.

How to support your team members’ career quilts

You don’t just stitch your own quilt. Managers (from first-line leaders through senior executives) have an enormous influence on whether your team members feel boxed into ladders or supported in building something broader. One of the most helpful things you can do is expand the conversation beyond titles and promotions, and focus instead on skills, experiences, and growth that can happen in many forms.

If someone feels stuck waiting for a promotion, instead of saying, “You just have to wait for the next role,” a manager might say: “Let’s look at the skills you want to build and how you can grow and demonstrate them in this role so you’ll be ready when the time comes.” That feels empowering and grounded, instead of simply waiting to be chosen.

If someone shares that they’re interested in trying something new, even if they’re not 100% sure it’s for them, respond with openness: “I’m glad you let me know. Let’s think about ways you can start getting exposure—maybe by shadowing someone, sitting in on a project, or meeting a few people on that team.” This acknowledges that growth often starts with exploration, not certainty.

And if someone shifts direction entirely—for example, moving from people leadership back into an individual contributor role—your words matter. Reminding them that it isn’t a step down, but another meaningful square in their career quilt can help make that transition successful, and it may matter more to them than you realize.

Redefining success

Ladders measure success by how high you climb. Quilts measure success by what you build along the way.

When we help people (including ourselves) see their careers in a different light, we stop equating promotions with progress. We start valuing depth over direction, learning over hierarchy, and stories over status. And careers become something people shape, rather than something they endure while waiting for their turn.

Because real growth isn’t about how high you go—it’s about shaping a career that reflects who you are and allows you to contribute something uniquely valuable along the way.

{"blockType":"mv-promo-block","data":{"imageDesktopUrl":"https:\/\/images.fastcompany.com\/image\/upload\/f_webp,q_auto,c_fit\/wp-cms-2\/2026\/01\/i-169-Ashley-Herd.jpg","imageMobileUrl":"https:\/\/images.fastcompany.com\/image\/upload\/f_webp,q_auto,c_fit\/wp-cms-2\/2026\/01\/i-11-Ashley-Herd.jpg","eyebrow":"","headline":"\u003Cem\u003EThe Manager Method\u003C\/em\u003E","dek":"Want practical leadership development training that actually sticks? Visit managermethod.com to learn more and order Ashley Herd’s book, \u003Cem\u003EThe Manager Method\u003C\/em\u003E.","subhed":"","description":"","ctaText":"Learn More","ctaUrl":"http:\/\/managermethod.com","theme":{"bg":"#2b2d30","text":"#ffffff","eyebrow":"#9aa2aa","subhed":"#ffffff","buttonBg":"#3b3f46","buttonHoverBg":"#3b3f46","buttonText":"#ffffff"},"imageDesktopId":91478992,"imageMobileId":91478994,"shareable":false,"slug":""}} -

Mark Zuckerberg’s new Miami mansion sits at climate change ground zero

Mark Zuckerberg’s new house in Miami Beach has sweeping waterfront views. It also sits at ground zero for climate change.

Zuckerberg and his wife, Priscilla Chan, are the latest in a string of billionaires and celebrities to move to Indian Creek, a private island in Miami’s Biscayne Bay. Neighbors include Jeff Bezos, who owns three homes on the island, as well as investor Carl Icahn, Ivanka Trump, and Jared Kushner.

Like much of Miami, the area faces mounting climate risks. “It’s very subject to flooding and rising seas,” says Stephen Leatherman, an environmental professor at Florida International University who studies the state’s islands.

Miami’s sea levels have risen eight inches since 1950. By 2040, the water is projected to be 10 to 17 inches higher than it was in 2000. As the water rises, that’s making “sunny day” flooding from high tides more common—up 400% over the last 20 years in Miami Beach—and storm surges are increasingly dangerous.

First Street, an organization that analyzes climate risk for specific properties, doesn’t yet have data for Zuckerberg’s house, which was newly built. But it estimates that a home down the street faces “severe” flood risk, with the potential for 5.9 feet of flooding in an extreme event. That property also faces possible 184-mile-per-hour hurricane winds and more than three weeks per year of extreme heat.

Indian Creek is an artificial island, created in the early 1900s by dredging sediment from the bay. It was once a mangrove forest, dense with trees and shrubs that helped shield Miami from storms. Today, only about 2% of mangroves remain in the area. Ironically, wealthy homeowners have often cut down mangroves in front of their own homes to have better views, increasing their flood risk.

The island sits around seven feet above sea level, slightly higher than some other parts of Miami. But other parts of Miami are sinking, and it’s not clear if the island, built on soft sediment, may also be subsiding. And “if a hurricane comes, they’re going to get a big storm surge in there,” says Leatherman. In theory, the water could surge as high as 15 feet to 20 feet in parts of Miami in a worst-case hurricane.

Of course, Zuckerberg and his neighbors have money to throw at the problem. “If you’re willing to build to a higher standard to mitigate against wind by putting concrete gables on your house, and you basically build a bunker, you can do that,” says Ed Kearns, chief science officer at First Street. “And if you raise that bunker up 10 feet, then you’re above the storm surge.” He points to a house that survived Hurricane Michaelwhen every nearby house was destroyed. (Zuckerberg and Chan did not immediately respond to Fast Company‘s request for comment.)

Climate change also poses other threats to infrastructure in the area—for example, saltwater is beginning to contaminate drinking water, and critical power stations are more exposed to flooding. Still, a billionaire has the option to easily leave in a disaster: Zuckerberg, for example, also owns other houses in California and Hawaii. The new house, worth perhaps $150 to $200 million, is only 0.087% of his net worth; if it was destroyed in a hurricane, he could handle the loss. (It’s worth noting that Zuckerberg may be changing his primary residence to avoid the possibility of a 5% wealth tax in California, which could put him on the hook for an $11 billion tax bill; so far, the proposed tax hasn’t yet been approved as a ballot measure for this fall’s election, but some wealthy residents are already moving.)

The same isn’t true for non-billionaires in the area. Floridians are already grappling with rising insurance premiums—or the challenge of getting insurance at all—as extreme storms keep hitting the state. As Miami’s population grows, housing costs are climbing, potentially pushing lower-income residents into more flood-prone neighborhoods. The city as a whole has far fewer resources to invest in resilience than the small, heavily fortified “Billionaire Bunker” island of Indian Creek.

The contrast is stark. Most Miami residents face increasing vulnerability to climate change. Billionaires like Zuckerberg can mitigate many of the risks, but doing so comes at a price and raises broader questions about whether $200 million might be better spent strengthening public resilience rather than building private fortifications.